Know Your Community

Intelligent Financial Inclusion

Our mission is to bridge the gap between rigorous regulatory compliance and the critical need for inclusive financial services. Supported by the United Nations Development Programme (UNDP) AI Trust and Safety Re-imagination Programme, we utilize a Federated Learning architecture, allowing financial institutions to train collaborative fraud models without ever sharing raw customer data. This ensures complete data sovereignty and privacy by design.

1.4 billion people

are excluded from formal financial services worldwide.¹

The Challenge

Financial Service Providers (FSPs) must meet strict Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) standards. However, automated solutions often result in the unintended financial exclusion of legitimate individuals.²’³

Our Solution

Our initiative focuses on strengthening compliance processes while simultaneously reducing financial exclusion. By minimizing false positives and streamlining KYC (Know Your Customer) and CDD (Customer Due Diligence) processes, we help more individuals maintain the formal bank accounts necessary to build transaction histories and access advanced financial services.

Our methodology is built upon the findings of “Risks to Financial Inclusion by Anti-Money Laundering and Financial Counterterrorism Algorithms”, which highlights the critical need for context-aware algorithms that prevent the misclassification of local financial behaviors. Furthermore, we utilize the ARISE framework, developed by Assessed Intelligence, to ensure that systems are responsible, innovative, and secure.

Key Objectives

Economic Empowerment: By ensuring that automated systems recognize legitimate livelihood patterns, we enable individuals to access the credit and capital required to achieve long-term economic mobility. (SDG 1, 5, 8)

Financial Resilience: By reducing the risk of unintended account closures and algorithmic misclassification, we ensure that individuals can maintain stable access to financial tools. (SDG 1.5, 10)

Financial System Innovation: We drive pro-poor supply-side innovation by providing the data architecture necessary for more inclusive product design. Our framework empowers Financial Service Providers (FSPs) to move beyond rigid, one-size-fits-all models and develop tailored insurance, savings, and credit products that reflect local financial realities. (SDG 9, 17)

Global Impact

Our mission is to create a digital economy that is truly borderless and inclusive. Beginning in Nigeria, we are partnering with national governments and leading financial institutions to develop data-driven personas for AI/ML pipelines. By integrating local behavioral context into automated systems, we bridge regulatory compliance with financial inclusion.

Partner With Us

We are actively looking to expand our network of forward-thinking FSPs and government agencies. If you are interested in implementing the ARISE framework or participating in our upcoming workshops, we would love to hear from you.

The Persona Engine

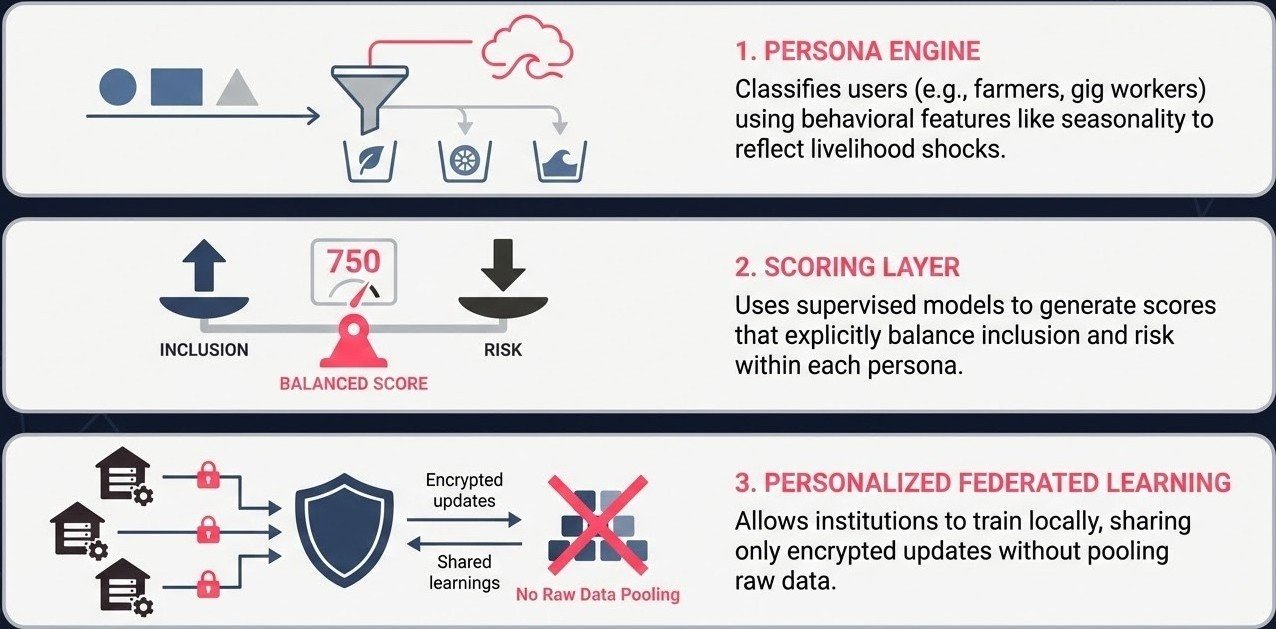

At the core of this system is the Persona Engine, which classifies users based on behavioral analytics specific to their local context. Rather than viewing customers as a monolith, these personas help AI systems and financial institutions understand the diverse ways people interact with money.

Why Personas Matter

Traditional automated systems often use one-size-fits-all rules to flag suspicious activity. This frequently leads to false positives, where legitimate users, such as small-scale traders or rural farmers, are locked out of their accounts because their transaction patterns don’t match a standard “ideal” profile.

How We Use Personas

To train these models effectively across the financial ecosystem without compromising security, we implement a Personalized Federated Learning framework.

Federated learning: (1) allows for collaborative model training across multiple financial institutions without the need to share or move sensitive raw data, and (2) enables the system to undergo continuous, adaptive learning as new financial behaviors and risks emerge across the participating network. The outcome of this framework is that:

Compliance is Smarter: Systems can distinguish between high-risk activity and unique but legal financial behaviors.

Inclusion is Intentional: Financial Service Providers can better serve thin-file customers who may lack traditional credit histories but have consistent community-based economic activity.

Accuracy is Improved: Reducing false positives ensures that more people can maintain the formal bank accounts necessary to build a long-term financial identity.

This approach moves away from rigid algorithms to persona-informed pipelines to create a financial ecosystem that is both secure against crime and open to the community.

Project Spotlight: Nigeria

In Nigeria, we are operationalizing the ARISE framework through a strategic partnership with The Presidential Committee on Financial Inclusion (PreCEFI).

Represented by the Office of the Vice President of Nigeria, PreCEFI provides the executive mandate necessary to align AI-driven financial systems with national development goals. As the home to Africa’s largest economy and population, Nigeria serves as the primary testing ground for this initiative.

Current financial exclusion in Nigeria is driven by a fundamental misalignment between automated systems and local realities.

The Reality

36% of adults lack access to formal financial services.⁴ In 2023, while 10.2 million rural women reported clear entrepreneurial goals, fewer than 0.5% had access to formal credit.² This lack of localized behavioral data prevents Financial Service Providers (FSPs) from innovating new credit and insurance products for those with entrepreneurial goals.

The Barrier

Traditional AML/CFT and fraud detection systems are often calibrated for Western markets, frequently misclassifying common Nigerian transactional behaviors, such as seasonal income and community-based transfers, as high-risk.

The Goal

Through our partnership with PreCEFI, we are building inclusive behavioral personas that allow financial service providers to innovate and provide tailored products for the unbanked and underbanked.

Our project objectives are categorized into three operational pillars:

1. Strengthen Compliance and Stability

Reduce False Positives: Calibrate AI/ML pipelines to recognize Nigerian financial realities, ensuring that legitimate users are not incorrectly flagged by misaligned global defaults.

Align with Regulations: Support Financial Service Providers (FSPs) in meeting rigorous obligations, including the Baseline Standards for Automated AML Solutions, to safeguard national and regional financial stability.

2. Drive Innovation and Empowerment

Build Inclusive Behavioral Personas: Leverage our partnership with PreCEFI to develop personas that allow FSPs to move beyond one-size-fits-all models and better understand underserved populations.

Enable Tailored Product Design: Provide accurate, localized data to facilitate the creation of pro-poor" credit and insurance products designed specifically for the economic advancement of the unbanked and underbanked.

3. Foster Ethical Leadership and Sustainability

Expand Capacity Building: Deliver tailored training in algorithmic ethics to senior leadership, ensuring technology remains aligned with human rights and organizational values.

Support Ethical Governance: Empower senior leadership to establish internal Ethics Officers, ensuring sustainable technology deployment and long-term institutional accountability.

¹ World Bank (2025, January 27). Financial inclusion overview. https://www.worldbank.org/en/topic/financialinclusion/overview

² Committee on Payments and Market Infrastructures. (2019, May 27). New correspondent banking data – the decline continues. Bank for International Settlements. https://www.bis.org/cpmi/paysysinfo/corr_bank_data/corr_bank_data_commentary_1905.htm

³ World Bank Group. (2016, October 7). De-risking in the financial sector. The World Bank. https://www.worldbank.org/en/topic/financialsector/brief/de-risking-in-the-financial-sector

⁴ EFInA (2023). Access to Financial Services in Nigeria. https://a2f.ng/

Get Involved

We invite you to engage with our project committee and find your role in this important project. Please fill in the form below and we will get back to you directly with a time for a meeting.